When Is the Right Time to Start Planning Your Retirement?

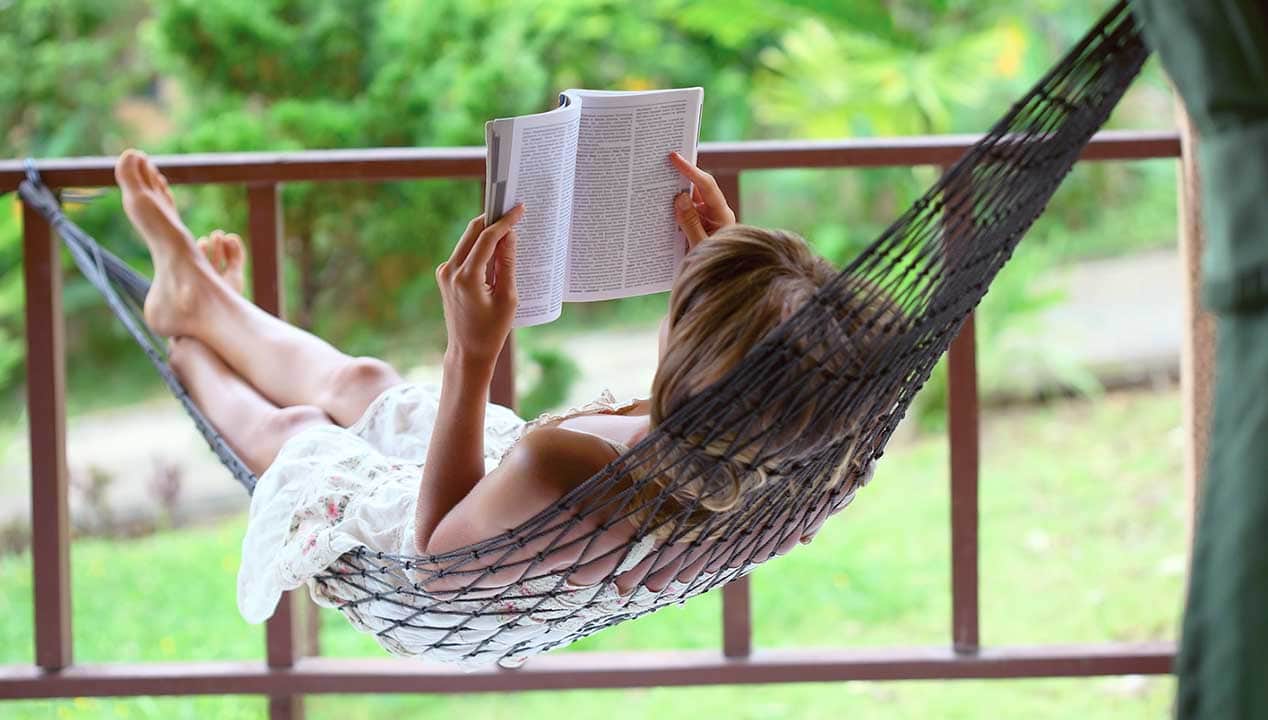

Immersed in the happy moments with their families and friends, everyday worries and different responsibilities, people seem to give little thought to long-term planning and retirement, believing that they have all the time in the world to deal with the future.

However, time passes quickly and unnoticeably – just think about this year and how the next one is just around the corner. Of course, stressing about what is yet to come is never the answer, but taking one step at a time will make your retirement preparation stress-free and you’ll spend your golden years leading a comfortable, happy life.

Facing The Responsibilities of a Family Caregiver

Ideally, everyone should start saving for their retirement as soon as they land a job and start earning regularly. In reality, a great number of people can’t find long-term employment that will provide them with a steady income right after graduating from college.

Even if you find a decent job in your 20s, you still think that it’s too early for retirement planning and you spend your money travelling or treating yourself with those little pleasures and luxuries. Soon enough, you fall in love and start a family, and preparing for your retirement seems borderline impossible.

You focus on family expenses, providing for your family and ensuring that your children have everything they need.

When it comes to children, even the most basic expenses pile up to a sizeable amount of money. You need to pay for their kindergarten, elementary school, high school and then college, with all those little expenses in between.

Overwhelmed by the responsibilities of a caregiver, parents often forget to think about themselves and their future. Only when they’re close to their retirement do they realise that they should have started preparing sooner.

Starting Early

With so many expenses, it will seem that no time is the right time for preparing for your retirement. However, the truth is that the earlier you start, the easier it will be.

You don’t have to put aside a half of your salary every month – even the smallest investment in your future can increase over time thanks to compound interest. Even if you stop saving for your retirement at some point due to unforeseeable circumstances, the amount you’ve already invested will have increased by the time you retire.

Therefore, it’s advisable that you start researching your options as soon as you find a steady job. If your job comes with employee pension benefits, you should figure out whether that will be enough for your retirement.

If you don’t have a long-term job, you should find a pension plan that will meet your needs. In addition, you should also take time to think about how you would like to spend your retirement. This will enable you to come up with a plan suitable for your retirement type and needs.

Seeking Professional Help

While learning about finances is crucial for your financial stability, you can still hire a professional advisor who can help you come up with the best retirement plan for you. They can help you reduce your expenses, deal with taxes and create your retirement budget.

In addition, consulting with a professional financial advisor will relieve the pressure and prevent you from making a mistake if you’re not familiar with the field.

Cutting Your Expenses

If you simply can’t afford to put aside a lot of money for your retirement, you should consider different ways to cut your expenses and increase your savings. By budgeting more and eliminating unnecessary expenses, you’ll have more money to invest in your retirement.

Furthermore, this will help you adopt a healthy financial habit that will ensure that your retirement fund lasts for the years to come.

You should consult with your spouse and see whether there are some unnecessary expenses that you can cut. Make a list of your monthly costs and go over it thoroughly. Think of different ways you can reduce your expenses even when it comes to necessities, such as transport or grocery shopping.

Remember to install the Rakuten browser extension when shopping online or use the Rakuten App to shop on your phone to make sure you get your Cashback! I had over $1000 in Cashback last year just by clicking the button. When you join using this link, you get $30 cashback as soon as you spend $30 in the app!

Finding Your Retirement Haven

Planning for retirement also entails considering different housing options. You and your spouse should think about whether moving away to a new home is the best option for you. It’s important that you consider this aspect of retirement planning as early as possible in order to have enough time to prepare for it.

Over the years, comfortable retirement homes have gained great popularity among retirees who often choose to sell their homes and move to a retirement community. Purchasing a retirement home just outside a city will ensure that you have your own peace and quiet, as well as different retirees’ amenities while still being close to an urban environment.

However, since this is a major change, you and your spouse should start preparing for it as soon as possible.

Starting In Your 50s

If you’re already in your 50s and you haven’t prepared for your retirement, you need to create an effective plan that will ensure your financial stability during your retirement. You should start by evaluating your current savings. Once you’ve gained a better insight into your financial status, you’ll be able to take appropriate steps to increase your retirement fund.

This is the period when you might have more taxes to pay because most people have the highest level of income in their 50s. Consulting with a financial advisor can help you reduce your taxes and increase your savings. Finally, you should get control over your expenses and consider selling certain valuables that you don’t need.

Although it’s never too early to prepare for your retirement, sometimes life gets in the way, making it impossible. It’s important that you come up with a retirement plan that will meet your needs and implement it as soon as possible.