Money, moolah, finance, cash, dollars, wealth. Whatever you call it, whether you love it (like I do) or hate it (stop that!!) there’s no denying we need it. And I promise it’s not a bad thing.

But a lot of us, yes… us… myself included, have created some bad financial habits over the years.

Think about who taught you about money. Chances are it was either your parents, or you were left to fend for yourself.

Thanks to the internet, we now have an amazing array of resources available to us to help break our bad money habits, and to you know… help us realise they are bad in the first place.

Remember, it’s never too late to change the way you approach your money. So, first thing’s first: kick these bad money habits to the curb and then start creating some good habits that help you control your finances and stop living paycheck to paycheck.

1 – Stop Living On Credit

One sure way to keep yourself in debt for the rest of your life is to live on credit. Finance companies and big banks have us in a spin believing we MUST have credit in order to establish a credit rating for ourselves – and while this may be true in some countries, it’s not the same for all.

If you’re at the point where you need to establish a credit rating, speak to a professional and independent advisor who can tell you exactly what to do.

If you’re living on credit and always getting loans or credit cards to pay for things, stop. Now. Find some help to establish a realistic budget for yourself where you can still live, but not have to keep putting things on credit. It’s not easy, but it’s totally worth it.

2 – Stop Paying the Minimum Repayments

If you’re only making the minimum prepayments on any debt you have, you’re going to be in the red a lot longer than you think and in a lot of cases, you’ll end up paying more than double for the items you purchased because of the interest charged.

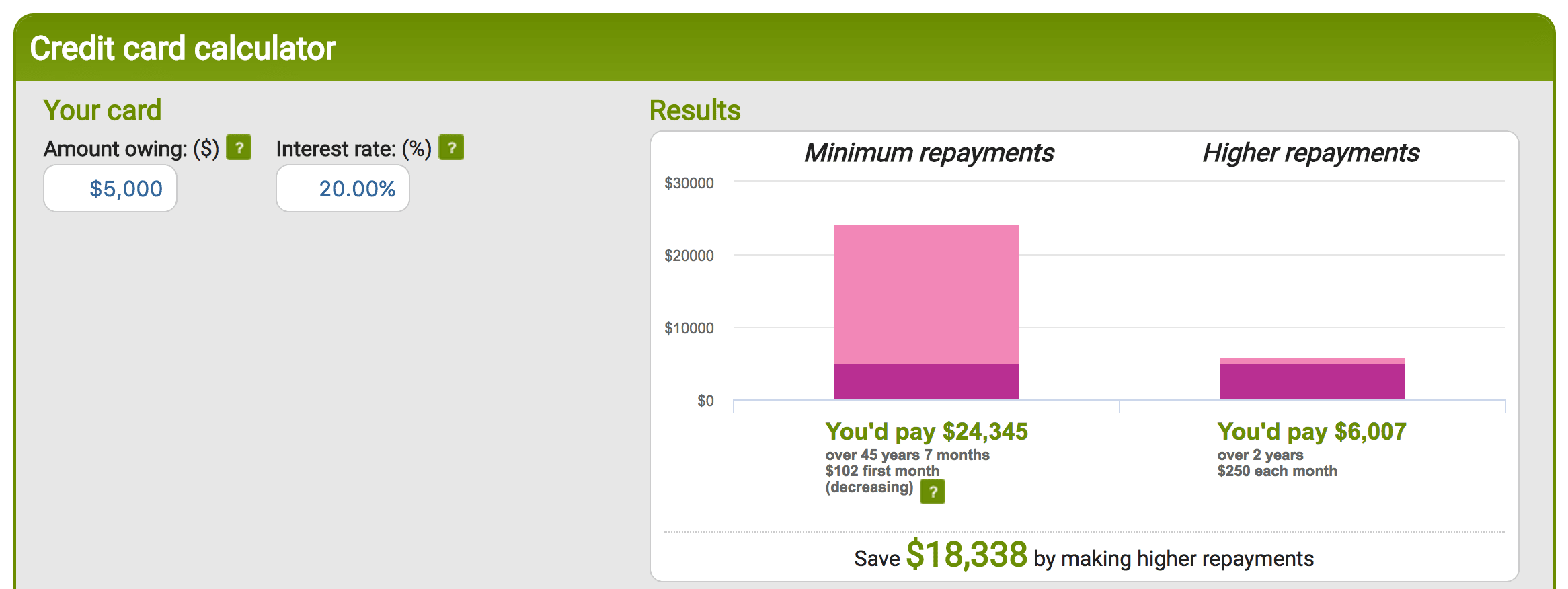

Go check it out for yourself using this calculator. I just did a quick check. On a $5000 credit card, with 20% interest (which is pretty conservative here in Australia), if you make ONLY the minimum repayments it will take you over 45 years to pay off your credit card (yes, years) and you’d end up paying almost $20,000 in interest.

But… chances are you wouldn’t pay it down completely and you’d just end up putting more and more on it, increasing the limit when the bank asks if you want to (because why wouldn’t they… you’re giving them over $20,000 in interest!!).

Every little bit extra you can pay off your debts reduces the amount of interest you have to pay. Get a plan in place, work out which debt you need to pay down first and do it.

3 – Stop Living Without a Budget

Budget isn’t a dirty word. I used to think it was. I thought for a long time that those who used budgets were those who couldn’t manage their money. And then I realised, actually… it’s the wealthiest people who have budgets and have a complete understanding of their money.

No successful business would survive without a budget, so why should you? Afterall, a budget is really more of a personal ‘Income and Expense Report’ isn’t it?

They aren’t difficult to do and they don’t have to be restrictive. I don’t buy into the whole ‘budget every single purchase you’re going to make and don’t spend a cent extra’. I don’t have time for that… and that means I won’t stick to it. But I do have a set amount for ‘spending’ and ‘entertainment’ each week and that makes sticking to a budget a whole lot easier.

4 – Stop Hiding From Your Money Issues

Think sticking your head in the sand is going to make your money issues go away? Uh no. If you have people chasing you for debts, they are going to keep coming. And then they are going to send in the bigger guys. And it’s just going to make life hell for you. Stop hiding, call the companies you owe money to and set up payment plans.

The same goes if you’re living on credit and spending more than you earn. That isn’t sustainable. Stop hiding from the issue, address it and get it sorted. Now.

5 – Know Your Expenses

You cannot possibly be in control of your finances if you don’t actually know how much money you’re spending. And I’m not talking about ‘I spent all my pay’, I’m talking exact numbers of how much it costs you to live each and every week.

We all have basic expenses, and if your basic expenses are higher than your income then you’re not in the greatest situation and you need to work that out now.

If you need some help with this, you can check out our article about the 3 Simple Steps to Take Financial Control. There’s even some free worksheets you can use to get on top of it all.

6 – Stop Wasting Money

Can you go shopping without buying something? Think about the last items you purchased… did you need them? Not just want them but actually need them. And what purpose do they serve?

We are obsessed with ‘stuff’. We buy things to make us feel better but that gratification is short lived and we are left with excess. Excess items, excess food, excess clothes. Things we don’t need and sometimes don’t even want… but we buy it anyway.

It doesn’t just apply when we are shopping. I went through a phase where I was buying a coffee every single day. Most days I was buying one for my husband too. On average, that’s 7 coffees a week for me and at least 5 for my husband. That’s 12 coffees at around $5 each – meaning I was spending $60 every single week on takeaway coffee. That’s $3120 a year! When I could have just as easily made the coffee at home and taken it in a cute travel mug.

Where are you wasting money?

7 – Stop Spending Every Last Cent

Are you the kind of person who feels like they need to spend every last cent of their paycheck each and every week? Like, if there is money in your account then it needs to be spent?

Unless you’ve got a fantastic budget in place that allows for your spending money each fortnight and allows for your savings too, then this is a dangerous habit.

If you’re this kind of person, then getting a budget in place is imperative. You could even challenge yourself by leaving a set amount of money in your account at all times and see if you can actually leave it there. It might be more difficult than you expect.

8 – Avoiding Financial Goals

Creating goals is an amazing way to push yourself forward. It constantly amazes me how many people don’t have specific financial goals, or have a goal like ‘I want to be debt free’ but don’t give anything else to their ‘goal’.

When setting financial goals for yourself, consider things like what it is you want to achieve, how exactly are you going to achieve it and when you want to achieve it by.

For example, instead of saying you want to have enough money to go on a holiday, create a goal by saying you want to have $1000 to go on a holiday in June.

To achieve that you’re going to create a specific holiday bank account, set up an automatic transfer of $50 each week.

This will take you 5 months to achieve. But you want to get it done within 4 months so to make up the extra money you’re also going to give up your daily coffee and every time you go to buy a coffee when you’re out, you’re going to transfer that $5 to your holiday savings account.

See how getting really specific with your goals includes an action plan for how you’re going to achieve it? This makes your goals far more powerful and far more likely to be achieved.