11 Financial Habits You Need To Start Today

Controlling your finances isn’t something that we just know how to do. It’s a skill that we need to learn, and a habit that we need to implement.

Creating these financial habits that you can include in your day to day activities will help you keep control of your finances and will help you achieve more financial freedom and you thought possible.

Keep in mind these financial habits are ones you need to practice and work on and are ones that will develop over time. You can start implementing them today, but you don’t have to be perfect at them.

Many people will give up on creating a budget (I promise it’s not as complicated or painful as you may think) as soon as they feel it’s not working, or they stop creating financial goals once they’ve reached one of them…

These habits will totally transform how you approach and manage your finances! Start with implementing a few (#1 and #2 first!!) and add the others in as you can. And have fun with it! Money is fun!

1 – Track Your Income

The two biggest mistakes people make with their finances is that they don’t track their income and they don’t track their expenses (see next). You might be thinking ‘but I earn the same amount of money every single pay, why do I need to track it’? Tracking your income doesn’t just mean you know how much you earn, it means you’re actively monitoring your finances and actively tracking them.

It can also be motivating to add extra income in there. Track everything. Did you sell an old piece of furniture you didn’t need anymore? That’s income! Add it! Maybe you’ve gone on a big decluttering and selling mission – track how much you’ve earned. You’ll be amazed at how much money can be made doing these things.

You don’t need to get all fancy to track your income and expenses. You can use a simple printed sheet to keep track, or even a spreadsheet.

2 – Track Your Expenses

How much did you spend last month on groceries? Clothes? Eating out? Unless you’re tracking your expenses it’s impossible to keep up with everything. The quick trip to the grocery store here and there can add up to hundreds of dollars over a month, especially when you go to pick up one thing for dinner and come home with half of aisle 5.

Knowing exactly where your money is going is so important. You’re never going to be in control of your finances if you don’t know exactly what’s coming in and going out. A business would never survive if they didn’t track their expenses, so why should you take your finances any less serious?

3 – Know Your Debts

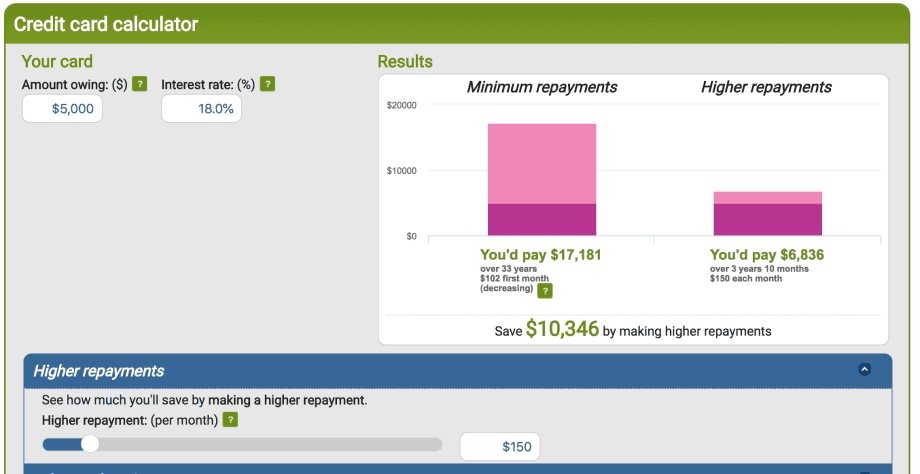

This isn’t just about knowing how much money you owe, but also knowing how much it’s costing you to owe that money. The true cost of your debts.

Take a look at this example: Say you have a $5000 credit card and you only pay the minimum payment. With an interest rate of 18% (fairly standard) you’ll end up paying over $17,000. But that’s not the only ridiculous part. It will take you over 33 years to pay it off!!! And that’s only if you don’t keep using it for purchases!

You can use a calculator tool like this one to see how long your credit card will take to pay off if you make the minimum repayments versus if you pay extra.

Contrary to many people’s money mindsets, you don’t need to have debt, especially credit card debt. If you’re in a position where you have debt owing, your focus should be to pay it off as fast as you can. Debt costs you so much money, far more than you’d think.

Know your debts, know how much they are costing you, and get a plan in place to pay them off as soon as possible.

4 – Know Your Overall Wealth

This is something I wish I had starting tracking early in my twenties, rather than much later. Do you know your overall wealth? That is your assets minus your detbs. The final figure is your overall wealth.

Add up all of your assets, the money in your bank account, the money in your 401(k) (or Superannuation for those in Australia), any shares or investments you have, the value of your possessions if you were to sell them tomorrow and any other finanical positive you have.

Then work out all of your liabilities aka debts. Add them all up and work out the difference.

You can even use a spreadsheet (or good old pen and paper) to track how your wealth grows over time. It’s seriously interesting to know.

One of my most favorite tools for managing and tracking my money is PocketSmith. It syncs all of our finances, including our loans and assets – which means it shows us our overall wealth. It’s also great for finding and tracking changes in our spending (so we can budget accordingly). I’ve tried so many different apps and this is the only one that I loved. PocketSmith is so easy to use and my husband loves how he can see how much we have left in our budget at anytime.

5 – Set Financial Goals

Big or small, setting yourself financial goals (and creating a plan to achieve them) is such an important habit to develop. We tend to forget the smaller financial goals and only focus on the big ones – saving a deposit for a house, paying off a debt. But the problem with this is that because these are such big goals, we can easily become disheartened and lose track.

Set yourself smaller goals and celebrate when you achieve them.

Maybe your goal could be to save $100 a week for the next 10 weeks. Or to get your credit card debt down from $5000 to $3000 by a certain time. Or maybe you want to have a ‘zero spend’ month and not spend money on non-essential items for a whole month.

It’s important to have those big financial goals still, but it’s just as important to create smaller ones that you can achieve quickly to help keep you motivated and to remind yourself that you are doing a great job with your finances.

6 – Diversify Your Income

Did you know that most millionaires have multiple income streams? The number that gets thrown around most often is ‘7 income streams’, and while I’m not sure of its accuracy, it does make sense. This doesn’t mean you have to work 7 jobs, or have 7 businesses. It simply means that you should have more than one source of income.

It was only a few short years ago during the Global Financial Crisis that we saw how important these income streams can be. Many people lost their jobs, including jobs they thought were secure, and all of a sudden their source of money was gone.

For a lot people, starting a side hustle is a great way to diversify their income. You could have a second job, start a business of your own or use your skills to freelance.

For others, sources of passive income such as investments, shares or real estate may be the way to go.

Have a think about how you can diversify your income and start working on adding new streams to your cash flow.

7 – Stop Impulse Purchases

Are you the kind of person who has to buy something every time you go shopping? Perhaps you do it without even realising. Can you walk through Target without purchasing something (or half the store?). This is a guaranteed way to railroad any financial goals you have and to completely overspend.

Check out #2, keeping track of your expenses, and track how much you’ve spent in the last few months on ‘non-essential’ items.

If you do have an item you want to buy, take a week to think over whether you really do need it. If you still feel it is something you must buy a week later, then see if it fits your budget then. I’ve done this so many times and I can tell you, there have a been a lot of times that I’ve pretty much forgotten about the item a week later. Clearly not something that was essential.

It also helps to avoid shopping centres if you’re trying to save money. They are designed to pull you in and sell you to, there are teams of people whose job it is to create an environment that makes you want to spend money. Avoid the temptation and stay away. Catch up with friends at your local cafe or even better, catch up at each other’s houses and cook lunch or bake some cakes and save a fortune.

8 – Create a Budget and Stick With It

Budget isn’t a dirty word. For a long time I believe that budgets were for people who couldn’t manage their money, or for those on low incomes but when I realised how powerful they were, I have never looked back.

The key is that your budget needs to evolve with you and it needs to change every single pay cycle. Yup. Every pay cycle.

You can have your core budget, one that covers all your fixed expenses, but then you need to budget for the things that come up in your life. The dinner date you have for a friends engagement, the present you have to buy for your Dad’s birthday, the extra travel expenses you’ll have when you go to visit your sister.

Budgeting for these expenses means you’re more likely to stick to your budget because it’s realistic.

And never forget to budget for spending money for yourself. Don’t be overzealous and expect to be able to save every cent. For many of us, it’s not possible and we will become disheartened really quickly.

Budget a percentage of your income to your own spending money. This might be for you to splurge on things you want, buy a coffee on the way to work or pretty much anything non-essential that doesn’t fall into your budget categories. This is the key to creating a budget you’ll stick to.

Using a budgeting template can help you create your budget. Here’s a free one you can download:

9 – Start an Emergency Account

Did you know that only 39% of Americans have enough savings to cover a $1000 emergency? Do you fall into that category? What would happen if you had a financial emergency and needed $1000 right now?

For many, it’s a scary and incredibly stressful thought. Creating an emergency account doesn’t just mean you’ll be covered in times of need but it also gives you this incredible breathing room and significantly reduces your stress and fear around money.

I believe an emergency account is so important that I recommend creating this account and having at least $1000 in it before paying out any debt and before doing anything else. This needs to be your number one priority. Once you have this emergency fund, you can start working on paying down debts and building up savings.

You can even work on decluttering your home (see #10) to help build up the funds for this account.

It is important to know what this emergency account is for and to not touch it unless there is a genuine emergency. It should be your last resort and only used if there is no other option.

10 – Declutter Your Home

You’re probably wondering how decluttering your home can relate to being a ‘financial habit’ but stick with me… I promise they are connected.

Have a think about all the things in your home. Do you have a lot of ‘stuff’? Look around you at everything you can see. Does it all serve a purpose? Does it all make you happy?

For many of us, we tend to buy things in order to make us happy. And it works… for a few minutes (maybe a little longer for some items) but then they turn into dust collectors. Things that sit at the back of shelves, never being used, and rarely being seen.

Decluttering your home does two things for your finances – it allows you to take stock of what you have, and maybe you’ll realise you have 4 fancy cake trays you totally forgot about and you won’t buy another one. And it also helps you to realise how much ‘stuff’ you have, and can deter you from making impulse purchases in the future and storing things unnecessarily.

You don’t have to do it all at once. Go through your closet first, then start on each room of your home, one room at a time. I always recommend starting and finishing with your closet, because you can always declutter more a second time around.

11 – Automate Your Bill Payments

Late fees are a killer. They can be so incredibly expensive and you know what? They are completely unnecessary and avoidable. You literally get nothing from paying a late fee – so make sure you don’t get them by automating your bill payments.

Create a specific account for your expenses and ensure you pay into it the correct amount every pay cycle. This means when your bill payments come out of this account, you’ll know there’s always going to be enough money in there.

You could also put a ‘buffer’ in the account to make sure it doesn’t get below a certain amount.

Most banks will allow you to create automated payments so you never have to keep track of what payment is due when, you just put your money into the account and everything is covered.